Will Rising Steel Prices Impact Global Nail Supply in 2025?

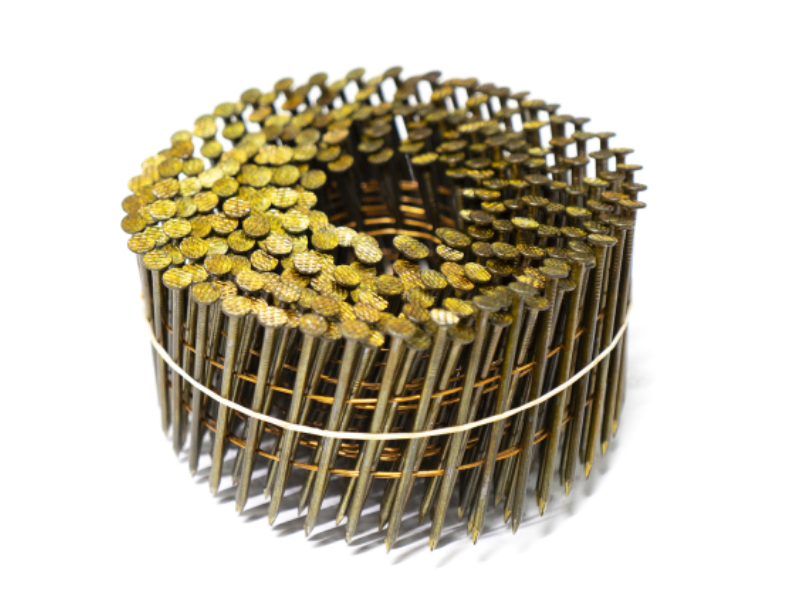

The fastener manufacturing industry is facing significant headwinds as raw material costs continue fluctuating in early 2025. Steel prices, which directly impact the production of collated nails, steel nails, coil nails, and construction iron nails, have created uncertainty across the global supply chain. For B2B buyers, construction companies, and hardware distributors, understanding these market dynamics has become essential for strategic planning. Let's examine what's happening in the nail manufacturing sector and what it means for your business.

Raw Material Volatility: How Steel Prices Affect Nail Production Costs

Global steel wire prices—the primary raw material for nail manufacturing—have experienced notable fluctuations throughout late 2024 and into 2025. These variations stem from multiple factors: iron ore supply constraints, energy cost increases in major steel-producing regions, and shifting international trade policies affecting raw material flows.

For Chinese nail manufacturers operating large-scale facilities, these fluctuations present both challenges and opportunities. Established factories with integrated supply chains and long-term supplier relationships can better absorb short-term volatility compared to smaller operations dependent on spot market purchases. This is creating a competitive advantage for professional nail suppliers who invested in supply chain resilience.

What does this mean for B2B buyers? Construction companies and hardware distributors sourcing collated nails, construction iron nails, and other fasteners should expect price adjustments throughout 2025. However, partnering with financially stable Chinese nail manufacturers who can provide transparent pricing structures and forward contracts helps mitigate uncertainty.

Production Technology: How Automation Cushions Cost Pressures

Interestingly, while raw material costs pressure the industry, advanced manufacturing technology is helping offset these increases. Leading Chinese nail factories that invested in automated production lines are seeing operational efficiency gains that partially counterbalance higher steel costs.

Modern Danish nail-making machines and German coil nail production systems reduce labor costs, minimize material waste, and increase output consistency. For products like pneumatic coil nails and strip-collated nails requiring precise specifications, automation ensures quality while controlling costs. Factories producing 6,000+ tons annually with fully automated systems maintain better cost structures than those still relying on semi-automated processes.

For professional buyers, this technological divide matters significantly. Nail suppliers still operating older equipment will likely face steeper price increases as they lack efficiency advantages to offset raw material costs. Smart procurement strategies increasingly favor manufacturers demonstrating technological leadership.

Trade Dynamics: Shifting Export Patterns from China

China remains the world's dominant nail manufacturing hub, producing everything from basic steel nails to specialized headless iron nails for global markets. However, 2025 is witnessing subtle shifts in export patterns as international buyers reassess their supply chain strategies.

Markets in North America, Europe, Australia, and Southeast Asia continue depending heavily on Chinese nail exporters, but they're becoming more selective about supplier partnerships. Rather than seeking the absolute lowest price, professional buyers increasingly prioritize suppliers offering comprehensive quality documentation, reliable delivery schedules, and technical support.

This trend benefits established Chinese nail manufacturers with modern facilities, international certifications, and proven track records. Companies that invested in ISO certifications, product testing capabilities, and customer service infrastructure are capturing market share from competitors competing solely on price.

For hardware distributors and construction material suppliers, this shift suggests a recalibration: building strategic partnerships with quality-focused manufacturers rather than transactional relationships with bargain suppliers.

Specialty Products: Growing Demand for Engineered Fasteners

One bright spot in the nail industry involves increasing demand for specialized products. While commodity steel nail prices face pressure, engineered solutions like weather-resistant coil nails, high-strength construction iron nails, and precision headless iron nails command premium pricing.

This reflects broader construction industry trends toward specialized applications. Green building standards require corrosion-resistant fasteners. Modular construction demands precisely manufactured collated nails for automated assembly. High-end furniture and architectural millwork need invisible fastening solutions. Each application creates opportunities for manufacturers offering technical expertise alongside products.

Progressive Chinese nail factories are responding by expanding R&D capabilities and product portfolios. Rather than producing only generic fasteners, they're developing application-specific solutions for demanding markets. This strategy helps offset commodity pricing pressures through value-added differentiation.

Supply Chain Resilience: Lessons Applied from Recent Disruptions

The global supply chain disruptions of recent years taught harsh lessons that continue influencing purchasing strategies in 2025. Construction companies that experienced project delays due to fastener shortages now prioritize supplier reliability over marginal cost savings.

This has created competitive advantages for Chinese nail manufacturers demonstrating supply chain stability: maintaining substantial finished goods inventory, owning raw material sourcing, operating backup production capacity, and having proven logistics networks. When market volatility strikes, these capabilities mean the difference between meeting customer commitments and disappointing them.

Professional B2B buyers increasingly conduct supplier audits examining not just pricing and quality, but also business continuity planning. Can this supplier deliver during market disruptions? Do they maintain safety stock? What happens if their primary raw material source becomes unavailable? These questions shape long-term partnerships.

Sustainability Regulations: Environmental Compliance Costs

Environmental regulations affecting nail manufacturing continue tightening, particularly in coating processes and waste management. Galvanizing operations, essential for producing corrosion-resistant steel nails and coil nails, face increasingly strict emissions standards and waste disposal requirements.

Chinese nail manufacturers in provinces like Fujian and Zhejiang are investing in cleaner galvanizing technologies, waste recycling systems, and energy-efficient production equipment. These improvements carry capital costs that eventually flow through to product pricing, but they're becoming non-negotiable for suppliers serving environmentally conscious markets.

For international buyers in Europe, North America, and Australia, environmental compliance documentation from suppliers grows increasingly important. Construction projects requiring green building certifications demand fasteners from manufacturers meeting specific environmental standards. This creates another differentiation point favoring established, compliant suppliers over lower-cost alternatives cutting environmental corners.

Strategic Outlook: What Should B2B Buyers Expect?

Looking ahead through 2025, the nail manufacturing industry will likely continue experiencing moderate cost pressures from raw materials, partially offset by automation efficiencies and specialty product premiums. For construction companies, hardware distributors, and industrial manufacturers, several strategic considerations emerge:

Diversification remains wise, but prioritize quality suppliers over simply finding the cheapest alternatives. Long-term partnerships with established Chinese nail exporters provide better value than constantly switching suppliers chasing minimal price advantages. Technical support matters increasingly as applications become more specialized. Supply reliability justifies modest price premiums given the costs of project delays.

The nail industry, like construction broadly, is maturing beyond pure commodity competition toward value-based differentiation. Manufacturers investing in technology, quality systems, environmental compliance, and customer support will thrive. Those competing solely on price will struggle.

For buyers navigating these dynamics, the message is clear: build relationships with suppliers positioned for long-term success, not just short-term savings.